Overview of the hottest crowdfunding platforms in Switzerland

A professional analysis of top crowdfunding platforms in real estate by Alexander Hübner, real estate investor and property manager, one of Switzerland top 5 entrepreneurs in the service sector (according to Swiss Economic Forum), CEO of Le Bijou, real estate investment management firm.

Assuming that you earned a certain amount of capital (let’s say up to 500K CHF) you must have started exploring possibilities that would help multiply it. Considering some available possibilities of multiplying it through investments you must have realized that:

- Banks offer a very small percentage of revenue from savings accounts which means you would not benefit much, therefore there is no point of investing there;

- Investment banks such as Credit Suisse are not interested in managing small capitals;

- Stock investment requires extensive knowledge in the field; over 95% of funds can’t outperform the market in the long run (surprise!);

- And the crypto industry is a subject to great risk because its volatile in nature.

So where to invest?

Such a lack of investment options for small-sized investors contributed to the growth of alternative investments market.

The main idea behind alternative investment solutions is “let’s put small amounts of investors’ money together and invest this larger capital in better investment opportunities, unavailable to these investors individually”.

One of the most popular alternative investment models in Switzerland is crowdfunding in real estate. The logic behind this form of investment is that the management company buys a property and then sells shares to its shareholders. To put it simply, small-sized investors put their money together to become owners of a large and lucrative building that none of them can afford to buy individually. In this investment method, you can become an investor with less than 100K. It is interesting that some crowdfunding platforms accept investors who have as little as 1000 CHF, which appeals to a lot of people and the gold rush begins.

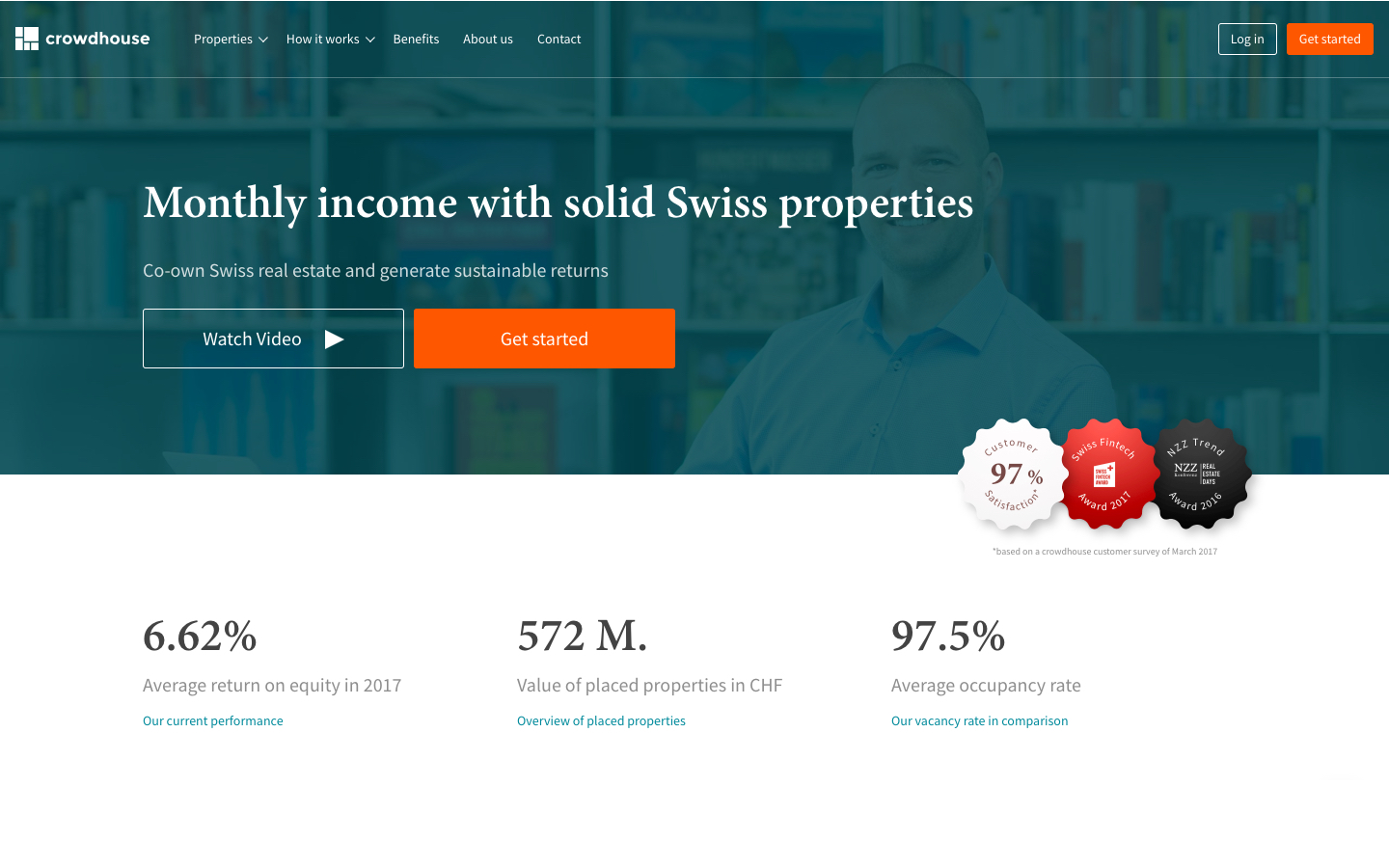

One of the most prominent crowd-financing platforms for real estate is Crowdhouse.ch which was named as “The leading Swiss provider in real estate crowd investment” in Cash.ch.

If you already considered investing through Crowdhouse.ch, then most likely you already noticed that there aren’t many reviews, personal experiences and risk overviews available online anywhere else apart from the platform's website.

Crowdhouse triggered my professional interest, as I’ve been investing in Swiss properties since 2013 on my own as well as with partners. So I decided to dig deeper to see how these crowd-financing companies actually work and produced a quick review that can help others to make better-informed decisions.

Before you get into the analysis of individual proposals in the real estate investment market, I would highly suggest that you learn the business model of each of the companies, so that you can understand their own incentives and the possible risks.

Let's explore how the crowd-financing model works when applied to real estate by using the example of Crowdhouse platform mentioned above.

So, how does crowd–financing work in real estate?

The properties selected by agencies are self-supporting which means that rental income exceeds mortgage interest and other expenses by a great margin.

Let's take a more detailed look into the concept of crowdhouse discovering step-by-step procedures of typical Swiss real-estate company.

Property selection

Type of buildings: Crowd-financing services look for quality real property that is either completely refurbished or new apartment buildings in locations where they expect increasing demand.

Before offering an investment, they carefully check the location and the building. The main factors in the selection of real estate are demand and overheating of the value of real estate in this location.

Market value estimation: Valuation partner draws up a market value estimate for each property and an additional external report is also compiled by construction experts. The lending bank inspects each property, as they are putting their own money towards it as a way of boosting their security.

If a property passes the inspections and the crowd-financing platform is in agreement with the seller regarding conditions, they secure it for you contractually and give a down payment.

Property purchase in co-ownership

- About half of the purchase price of the property is typically co-financed with a mortgage;

- The value capital is partitioned among several buyers and offered in co-ownership;

- When all co-owners have been determined, their value capital is transferred to the common property account. The loaning bank then transfers the purchase amount to the owner of the property. Service take care for the whole transaction process;

- After the purchase services take care of the management and the property asset management to thereby manage the property profitably, conserve its value and ensure sustainably stable returns.

Recurring rental income

The effective rent yield is usually transferred to the co-owners monthly or per quarter and definitively determined at the end of the year. Income varies depending on the agency, property purchased and market conditions and averages 5-7% per annum (when leveraged through mortgage loan).

Crowdhouse risks

After understanding the crowd-financing processes, let’s proceed and get familiar with its risks.

To fully assess all the risks, I will divide them into 3 parts:

- Risks associated with the purchase of real estate;

- Risks associated with the rental fee;

- Fundamental risks.

Purchase of real estate

Most of the risks associated with this type of investment are similar to the risks of buying property alone.

When you invest in real estate, you have to be ready to losses connected with the following reasons:

- Change in the attractiveness of the location;

- Real estate market fluctuation – volatility – short-term changes in the property’s value;

- The risk of the building (construction quality).

Rental fee-related risks

Your recurring revenues on existing buildings will essentially consist of rental income. They may decrease in the future based on several factors such as:

- Non-payment of the rent by the tenants;

- Vacancy rate; Source: Vacancy rates go up in Switzerland, and the rents keep falling; - UBS Real Estate Report

- Reduction of the rent due to the change in supply and demand;

- The reduction of the interest rate;

- Invalidity of the lease agreement (or of specific clauses);

- Rent reduction requests and other factors including force majeure and natural disasters;

Fundamental risks

- Your property is immediately pledged and there is a risk of losing it;

- You are also exposed to the risks associated with the bubble of the Swiss real estate market.

Risks specific to crowd financing services

- Small shares of properties are illiquid:

You are not buying a property, but a small piece of property that is much more difficult to sell. Big investment funds are not interested in buying 10%-20% shares of buildings, as the cost of the due diligence will be too high relative to the cost of the share (they would need to evaluate the whole building/location to buy just 10%-20% of the property, what doesn’t make sense financially).

So most likely you will be urged to sell your shares through your crowd-financing platform, where there may be no buyers for it. - Any changes to the project have to be discussed with all owners;

- Most properties financed by crowdfunding platforms are located in cities’ outskirts or in small towns, that means that the rental income is dependent on local companies’ office's activity and/or immigration. The smaller the city, the more it is dependent on the few companies that operate there. The trends are that foreign workers leave the country and that companies outsource their local offices to cheaper places.

Let’s try to sum up what we have.

Unlike bonds (with a guaranteed income) and giving your capital to an investment bank, in crowdhouse you buy an actual property, that’s why you are exposed to risks associated with the construction of these buildings, their condition, the location in which they are located, the laws of location and the conditions for leasing this building.

Properties are usually leveraged by the bank by 50%-60% (what doubles all the risks)

Now you understand how it works and what are the risks, let's get into a comparison of certain services. We will concentrate on their differences to discover how to choose the best options.

There are a few questions you have to answer before choosing one of them:

- Promised returns;

- Additional risks;

- Service fees;

- What is the minimum to invest in one project?

- And how many properties they had raised funds for?

Crowdhouse.ch and it’s alternatives review

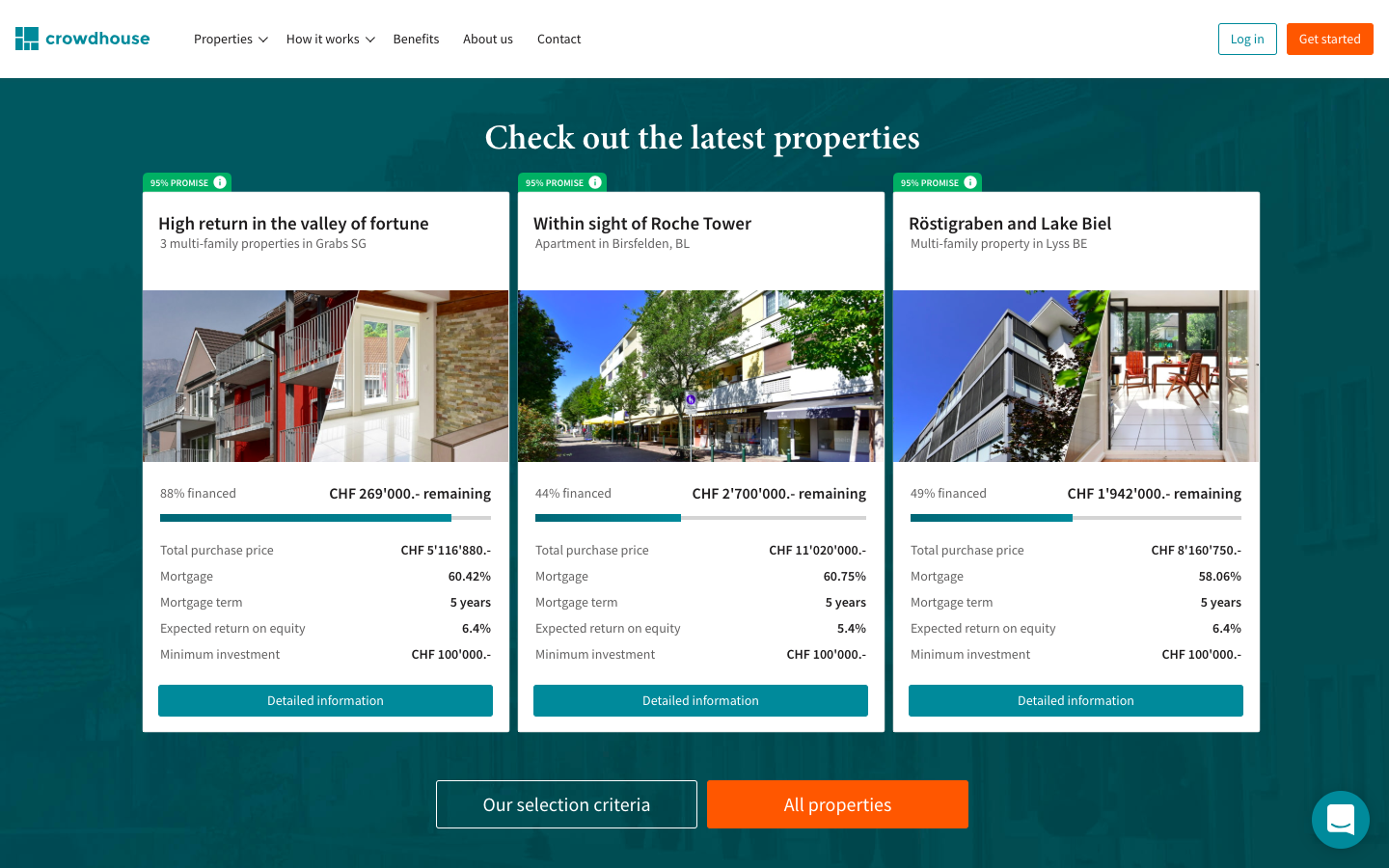

Crowdhouse

Estimated returns: 5–7% (actual returns will be around 4-5% before income tax, as a part of the revenue goes to security fund and will be locked in there; also, deduct the purchase fees).

Risks: as mentioned above.

They usually buy properties in small towns, where the demand for housing is dependent on a relatively small number of local companies (when compared to a bigger city); or, they buy properties in low-cost locations of bigger cities, where the demand is largely dependent on low-cost tenants, who are usually immigrants and can leave the country. If you lose tenants, the rental price goes down. If it goes down you have nothing to pay for mortgage interest and then you may have to sell a house to cover the bank services.

Fees: 3% of the purchase price of the respective property + 5–7.5% of the property's success for the property and co-owner management.

Minimum contribution: 100 000 CHF.

Until now, they raised funds for 59 properties, which is the biggest amount in the Swiss market.

Crowdhouse Alternatives

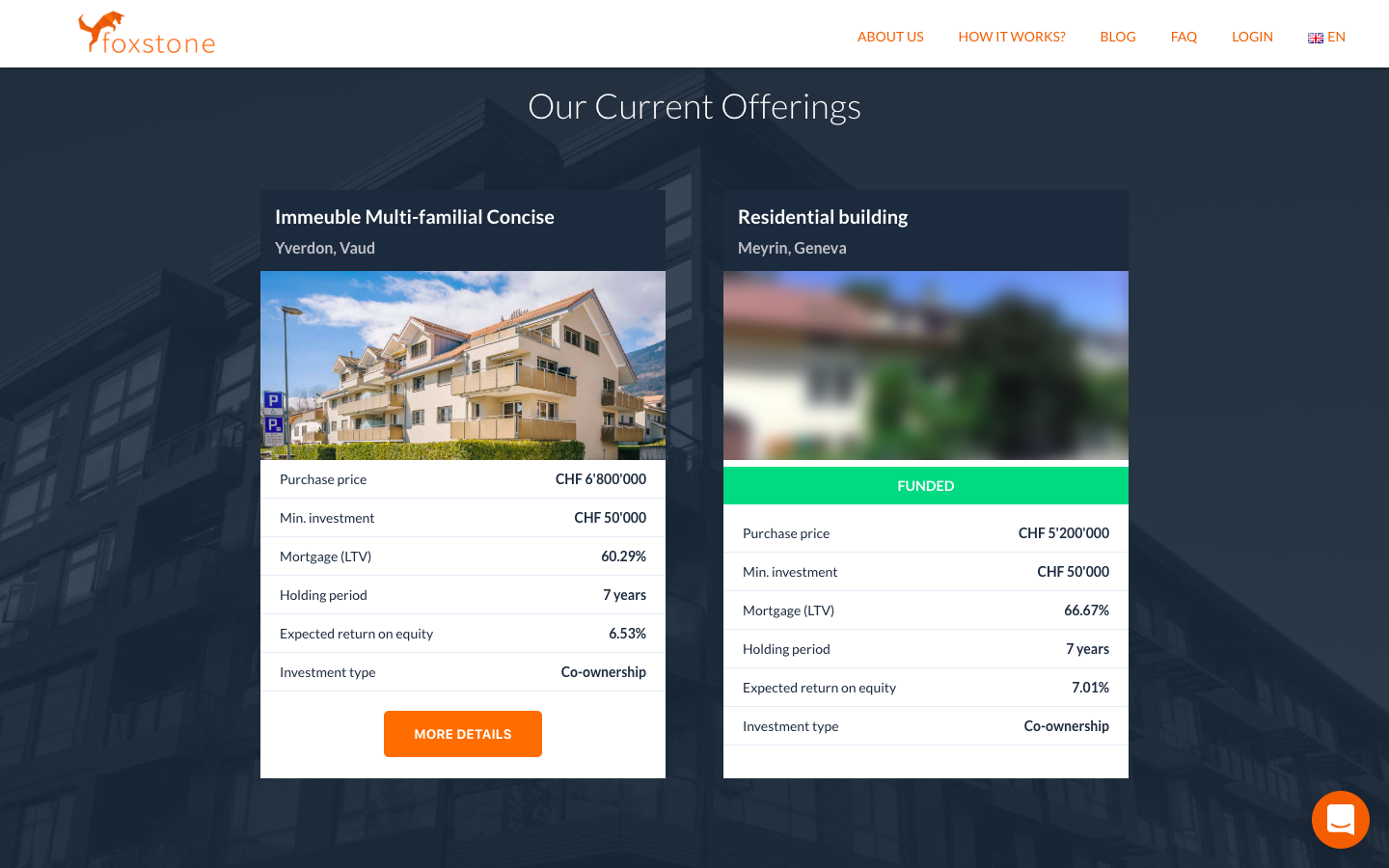

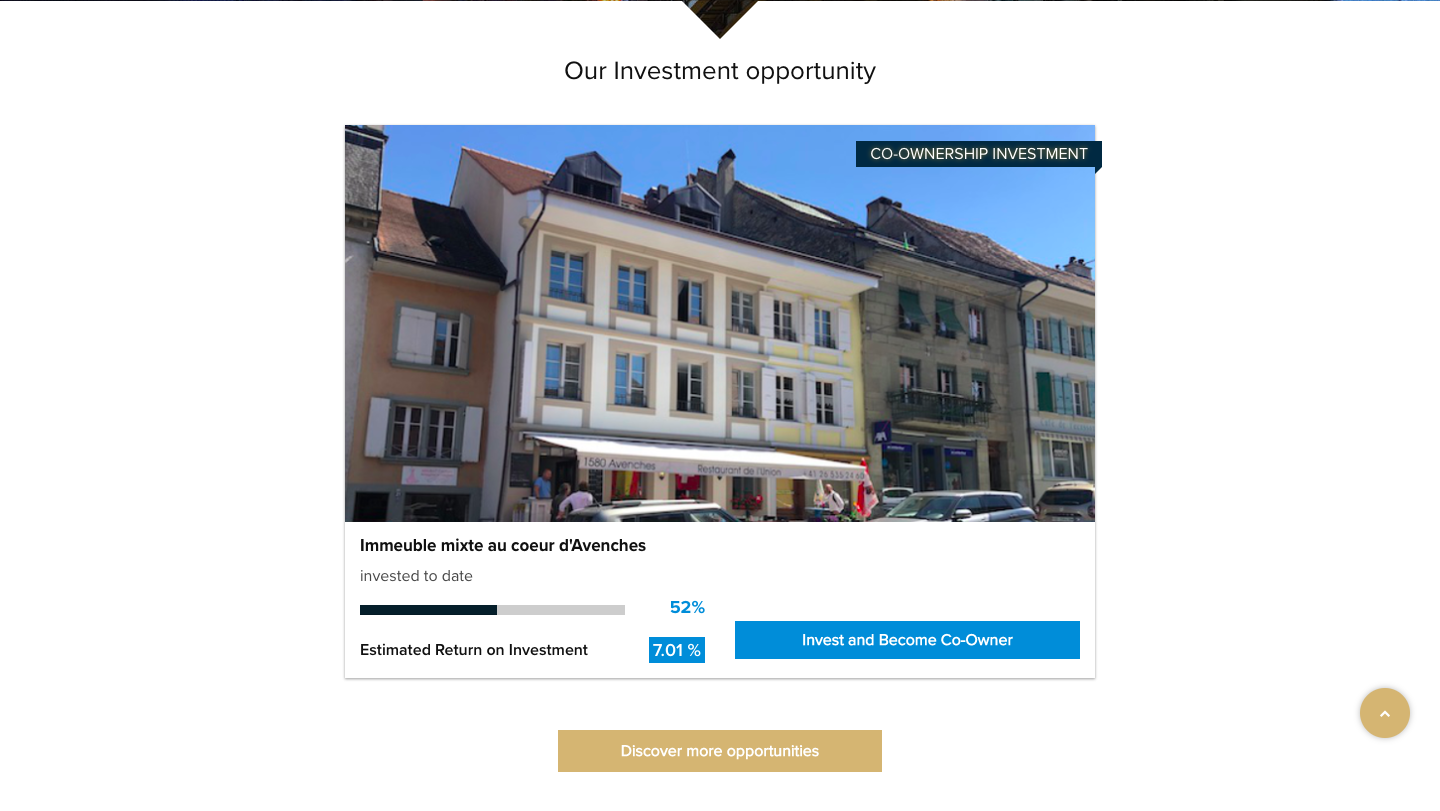

Foxstone

Estimated returns: 5.5–7%

Risks: as mentioned above + this particular company appeared on market just a year ago, so there is no information about how many properties they raised funds for.

Fees: 3% of the gross asset value once the transaction is closed and management fees of 0.25% to 0.5% of the asset price (this price is already deducted from returns), digressive according to the amount of the deal.

Minimum contribution: 50 000 CHF.

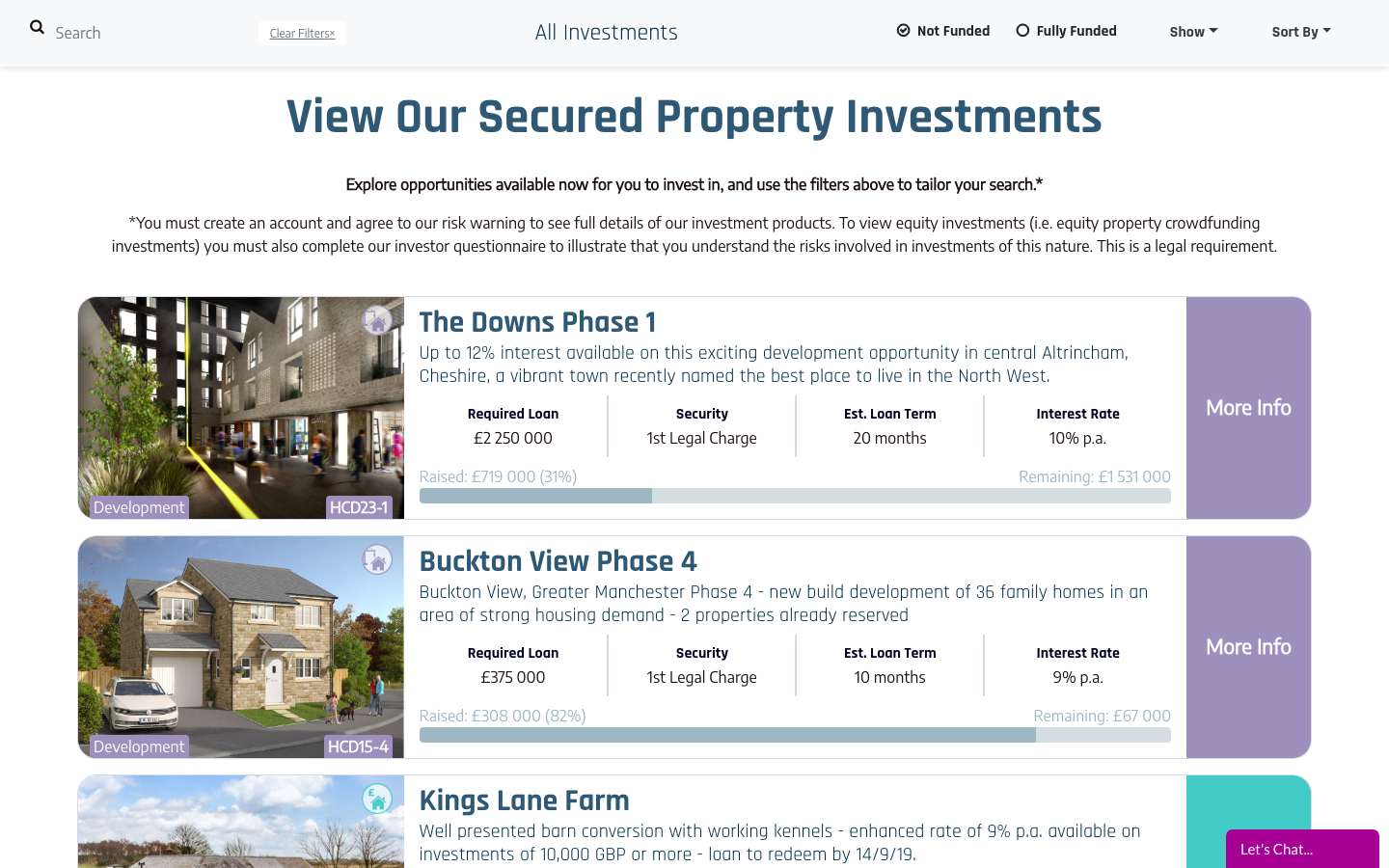

The Housecrowd

Estimated returns: 5–6%

Risks: as mentioned above + this service allows venturing into being an investor starting from 1000 GBP, which is quite a small sum that allows separating ownership between lots of investors.

Nevertheless, this firm has more than 350 properties they raised funds for, which is a large amount and is respectable.

Fees: information on the site tells us that fees are around 5% and can change a bit in different projects.

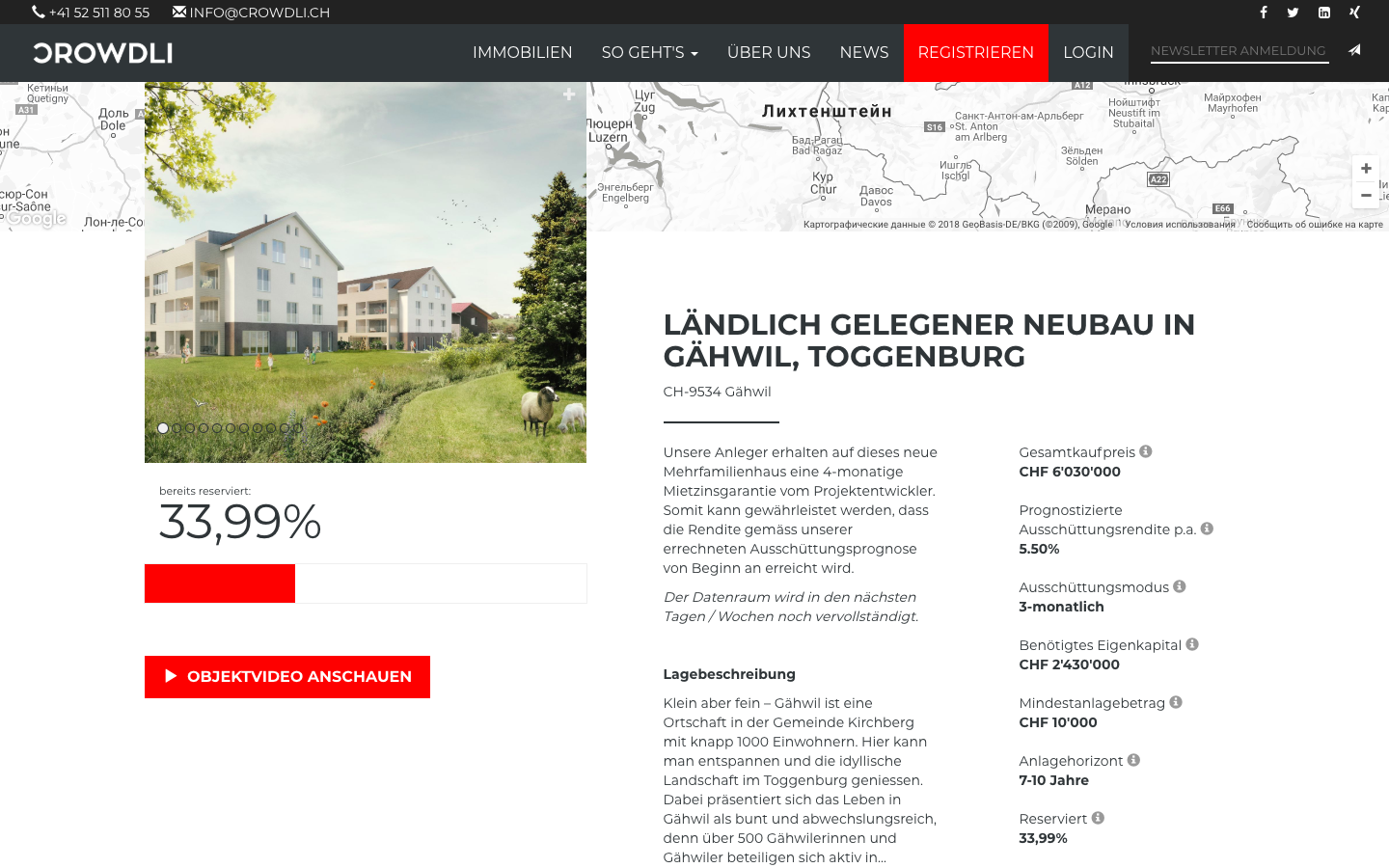

Crowdli

Estimated returns: 5.5-6%

Risks: as mentioned above + all property presented locates in villages with less than 10K population. In this case, you expose yourself to the undue risk of loss of liquidity of your property. And as a common flaw of this type of investment you own this property, and if it loses liquidity – you will have to lower rental rate or even sell it to cover the mortgage.

Fees: 3,6% (without VAT) of the gross asset value once the transaction is closed and you pay from 4% to 5% of years income for administration service (+ you cover the cost of promotion of your property).

You can become an investor by investing 10 000 CHF.

Crowdpark

Estimated returns: 5-7%

Risks: as mentioned above + this company has only 1 open proposition for co-ownership and doesn't show finished crowdfunding processes. This moment pushes us to realize that they might not be as experienced as we would like them to see. Also, the site of a company lacks any information about their fees and historical returns.

The minimum amount of investment for this option starts from 25 000 CHF.

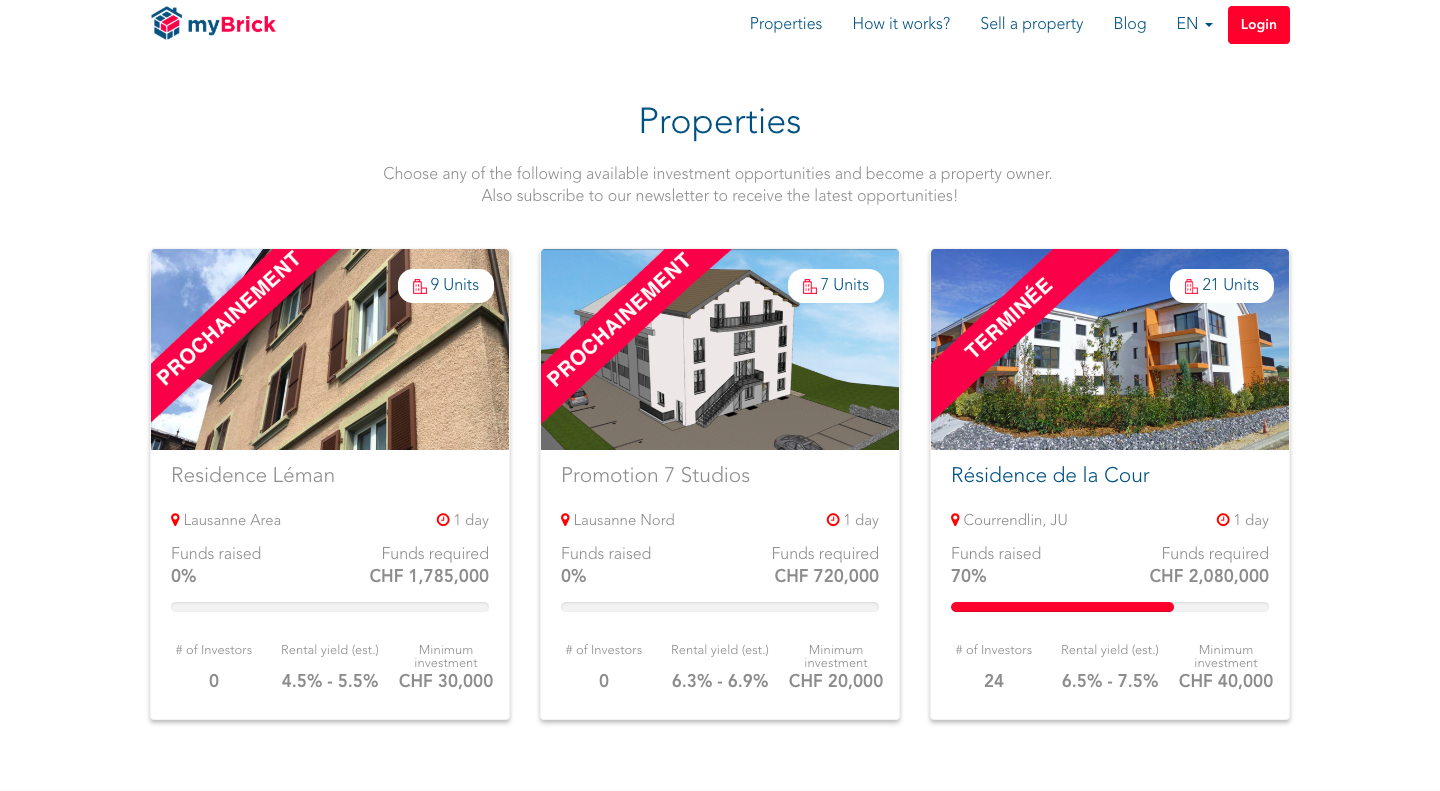

MyBrick

Estimated returns: 4.5-7.5%

Risks: as mentioned above + this company takes the biggest amount of loans from the banks (70+%) to cover the price of the property. Which means that in case of lowering the rental cost and losing tenants, owners will have to pay back the whole sum to a bank for its interest rate. The information on historical returns is not available at the time of writing of this material.

Fees: charges any investor 2-3% (Before VAT) of the amount invested to cover the expenses related to the preparation of the acquisition.

You can become an investor starting with 20 000 CHF investment.

Let’s step aside to have a look at what this market has to propose for us

Real estate market is overheated in major locations.

UBS Wealth research suggests that the Swiss real estate market is overheated in several major locations.

You can make a simple analogy with the stock market of the late 90s: you would hardly recommend someone to invest in IT companies that were at their peak in those years.

"Heat level" in different geographical regions of Swiss real estate market - source (UBS Wealth)

Liquidity problem: How do you exit if there’s a need?

Along with the market conditions and promises of services that will help you to get in, there should always be a matter of promptly exiting the market.

In case you need to return your investments promptly, or when the market starts to collapse, you will face the following problem: since the trade is conducted only on platforms similar to discussed above, you will have to sell your property mostly there. The amount of buyers on such platforms is quite limited, so most probably you won’t be able to sell your piece of the pie really quick.

Investment funds won’t be interested in buying 5%-10% share in a building, as the cost of due diligence will be too high relative to the amount of the investment - they can spend on due diligence half of the worth of your share. So financially it doesn’t make any sense to investment funds, as well as to any other institutional investors.

Risk/Profit ratio

Risks and profits are one of the most important factors that should be considered before making an investment of any type.

In the best case, we will receive about 6% per annum; the income is not guaranteed, and we have our money locked in real estate for 5-10 years without the real opportunity to pull them out. The model is capital intense and also you take a mortgage, that doubles your risks.

Personally, I came to the conclusion that investment in Crowdhouse and similar services don’t provide a fair reward for the risk. During my career, I have been setting up deals that would yield 7% fixed returns (bonds), and also other deals without even buying the real estate but rather leasing it, that would give me up to 21%, and 13% - 18% in average.

Taking into account all the risks described above, I thoroughly advise you to rethink the topic of the purchase of real estate as an investment.